An engine in 2025 converts energy into mechanical motion or drives intelligent systems. People see engines in many forms, such as internal combustion engines, electric motors, hybrids, and hydrogen engines. Technology and daily needs have changed what people call an engine.

By 2025, engines power not only vehicles but also smart systems and AI platforms that shape daily life.

Metric/Segment | Details |

|---|---|

Market Size in 2025 | USD 44.05 Billion (Hydrogen Combustion Engine Market) |

Leading Region | Europe (40% market share) |

Leading Application | Road vehicles (heavy-duty trucks) (50% share) |

Leading End-use Industry | Transportation & logistics (55% share) |

Leading Fuel Type | Pure hydrogen (70% share) |

People encounter engines in new ways every day:

Engines in 2025 include traditional combustion engines, electric motors, hybrids, and hydrogen engines, all focusing on efficiency and sustainability.

Electric motors offer higher efficiency, lower maintenance, and zero tailpipe emissions compared to internal combustion engines.

Internal combustion engines still power most vehicles but face challenges from stricter emissions rules and growing electric vehicle adoption.

The automotive industry is shifting toward batteries, electronics, and recycling, creating new jobs and requiring workforce retraining.

Consumers choose engines based on cost, convenience, and environmental concerns, with many favoring hybrids or electric vehicles for cleaner travel.

In 2025, the word "engine" describes a device or system that converts energy into motion or useful work. People recognize several types of engines, including internal combustion engines (ICE), electric motors, hybrids, and hydrogen engines. Each type uses different methods and materials to achieve efficient energy conversion. The definition now includes not only mechanical systems but also advanced electronic and digital technologies that support engine functionality.

Engine Type | Defining Characteristics |

|---|---|

Heavy-duty Diesel | Improved fuel efficiency, advanced powertrain integration, precise fuel flow control, enhanced thermal management, turbo compounding, digital solutions for remote monitoring and predictive maintenance |

Natural Gas Engines | Clean and quiet operation, expanding use in various transportation sectors |

Hybrid Engines | Combine combustion and electric systems, regenerative braking, advanced battery technology |

Hydrogen Engines | Use pure hydrogen as fuel, focus on zero emissions and sustainability |

Electric Motors | Rely on battery power, offer quiet operation, instant torque, and reduced maintenance |

Engine technology in 2025 reflects a shift toward sustainability, digital integration, and adaptability. Government policies, such as renewable fuel standards, encourage innovation and the adoption of cleaner fuels. The number of engine manufacturers has grown, and the market now includes a wider range of engine types and applications.

Modern engine components combine mechanical parts with sophisticated electronics. This integration improves performance, reliability, and environmental compliance. The following list highlights essential engine components found in vehicles and machinery in 2025:

Mechanical components:

Pistons and piston rings

Cylinder heads and gaskets

Camshafts and valves

Timing belts or chains

Valve train

Fuel injectors (mechanical and solenoid types)

Turbochargers (fixed and variable geometry)

Ignition systems (spark plugs and wiring)

Electronic components:

Solenoid-activated fuel injectors

Sensors (fuel rail pressure, exhaust gas temperature, NOx)

Electronic control units (ECUs)

Wiring harnesses

Emissions aftertreatment systems (EGR, DPF, DOC, SCR)

Onboard diagnostics (OBD-II)

Infotainment systems

Advanced driver assistance systems (ADAS) with cameras and radars

Battery management systems and motor controllers (in electric and hybrid engines)

Advancements in materials have transformed engine components. Manufacturers use lightweight alloys, titanium, ceramics, and composites to reduce weight and improve durability. Precision casting and 3D printing allow for complex, high-performance parts. Embedded sensors and engine control systems enable real-time monitoring and adaptive optimization, enhancing engine functionality and efficiency.

Engine design in 2025 focuses on balancing power, efficiency, and sustainability. Engineers optimize combustion chambers, turbochargers, and fuel injectors to meet strict emissions standards. The powertrain now relies on both mechanical strength and digital intelligence, reflecting the evolution of engine technology.

Note: The combination of mechanical and electronic engine components supports advanced diagnostics, predictive maintenance, and improved safety features.

The internal combustion engine remains a central technology in vehicles and machinery. This engine converts chemical energy from fuel into mechanical motion. The combustion process takes place inside a chamber, where fuel mixes with air and ignites. High-pressure gases push pistons, which move and turn the crankshaft. This motion powers the vehicle or machine.

Aspect | Description |

|---|---|

Mechanical Components | Engine block, cylinders, pistons, valves, crankshaft, camshaft, engine head |

Chemical Process | Combustion of fuel with air produces high-pressure gases that push pistons |

Combustion Reaction | Hydrocarbon fuel reacts with oxygen to produce carbon dioxide and water |

Efficiency Factors | Air-fuel ratio, ignition timing, chamber design |

Performance | Power and torque depend on displacement, compression ratio, camshaft design |

Modern Enhancements | Electronic fuel injection, variable valve timing, engine control units |

Modern internal combustion engines use electronic fuel injection and advanced control systems. These improvements help engines meet strict emission standards and boost efficiency. Turbocharging and direct injection allow smaller engines to produce more power. Variable valve timing adjusts how the engine breathes, improving performance and fuel economy.

Note: The internal combustion engine uses both mechanical and electronic parts to optimize power and reduce emissions.

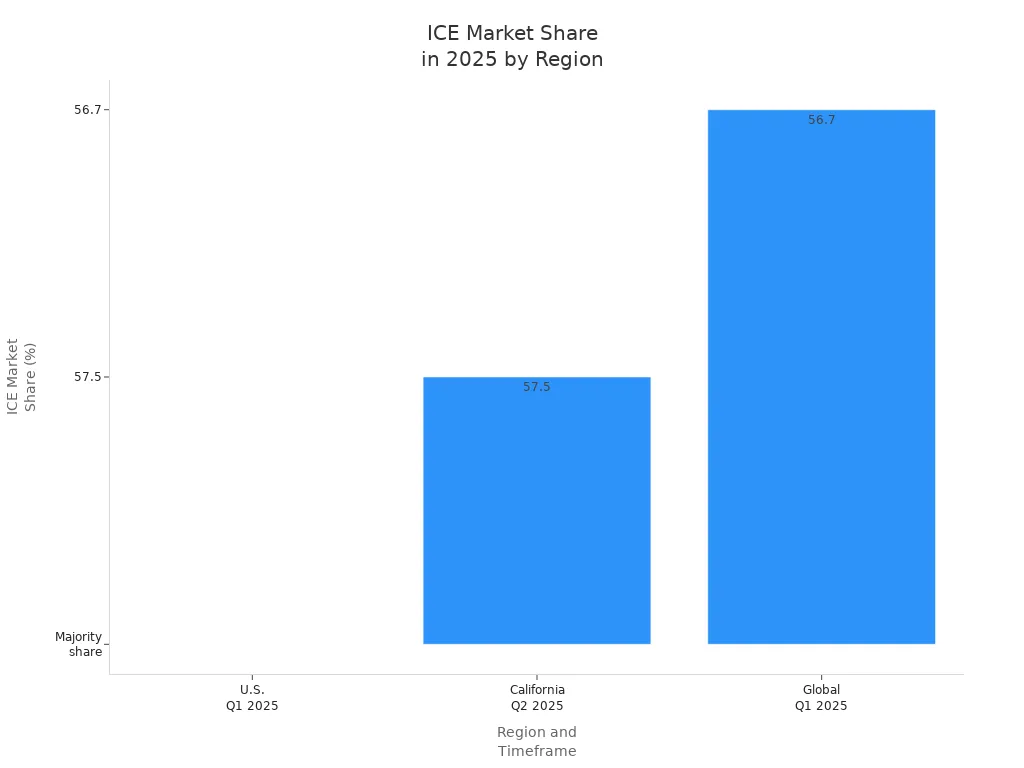

In 2025, the internal combustion engine still powers most vehicles worldwide. Despite a decline in market share, it remains vital in transportation and industry. The global market share for internal combustion engines in new vehicle sales stands at 56.7% in Q1 2025, down from 91.2% in 2019. Electric vehicles and hybrids are gaining ground, but the internal combustion engine dominates in many regions.

Region/Scope | Timeframe | ICE Market Share | EV Market Share |

|---|---|---|---|

U.S. (Q1 2025) | Q1 2025 | Majority share, 4.6% YoY decline | 9.6% of new light-duty vehicle sales |

California (Q2 2025) | Q2 2025 | 57.5% of new vehicle sales | 18.2% ZEV share |

Global (Q1 2025) | Q1 2025 | 56.7% of new vehicle sales | 43.3% electrified vehicles |

Regulations like CAFE standards and Euro 7 emission limits push manufacturers to improve engine design. They use lightweight materials, turbochargers, and advanced emission controls. The internal combustion engine adapts with hybrid systems and renewable fuels, helping reduce environmental impact.

The internal combustion engine remains essential in:

Passenger cars and trucks

Commercial vehicles

Marine and aircraft sectors

Power generation and agriculture

Challenges include stricter emission rules, higher production costs, and competition from electric vehicles. Manufacturers invest in both internal combustion engine and zero-emission technologies. The transition to electric power is gradual, so the internal combustion engine continues to play a major role in global transportation and industry.

The electric motor stands out from the traditional engine in several important ways. It uses electrical energy stored in batteries to create motion, while an internal combustion engine relies on burning fossil fuels. The electric motor converts electricity directly into mechanical movement, which leads to higher efficiency and smoother operation.

Aspect | Internal Combustion Engine (ICE) | Electric Motor (EM) |

|---|---|---|

Energy Source | Fossil fuels (gasoline, diesel) | Electrical energy stored in batteries |

Operation Principle | Combustion of fuel to generate mechanical energy | Conversion of electrical energy into mechanical motion |

Mechanical Components | Many moving parts: pistons, spark plugs, valves | Fewer moving parts |

Energy Efficiency | Lower efficiency due to heat loss | Higher efficiency (85-90%) |

Maintenance Requirements | Complex, maintenance-intensive | Lower maintenance due to simpler design |

Operation Characteristics | More vibration, less smooth operation | Smoother operation with less vibration |

Environmental Impact | Emissions from fuel combustion | No combustion emissions |

The electric motor achieves higher efficiency because it has fewer moving parts. It loses less energy to heat and friction. Electric motors reach 80-90% efficiency, while internal combustion engines often convert only 20-30% of fuel energy into motion. Electric motors deliver full torque instantly, so they do not need complex transmissions. Regenerative braking allows electric motors to recover energy during deceleration, which increases overall efficiency. They also connect easily to renewable energy sources, helping reduce pollution.

Electric motors provide a quiet, smooth ride and require less maintenance than traditional engines.

In 2025, the electric motor powers a growing share of new vehicles. According to the International Energy Agency, electric motors appear in about 25% of all new vehicles sold worldwide. This means one out of every four new vehicles uses an electric motor instead of a combustion engine.

Electric motors serve as the main driving force in many types of vehicles. Passenger cars, trucks, buses, and even microcars use electric motors for propulsion. New designs, such as axial flux and in-wheel motors, improve efficiency and flexibility. Orbis Electric’s HaloDrive motor, for example, powers passenger vehicles and commercial trucks. It also replaces diesel generators in heavy-duty fleets and marine systems. The HaloDrive motor increases vehicle range by 20% and improves fleet fuel efficiency by up to 61%. It offers up to 97% efficiency and lowers drivetrain costs by 35%.

Common applications of electric motors in vehicles include:

Passenger cars and light commercial vehicles

Commercial trucks and buses

Electric transport refrigeration units (eTRU) in trucks

Marine systems and aerospace platforms

Electric vertical take-off and landing (eVTOL) aircraft

Permanent magnet motors dominate the electric car market, but some manufacturers now explore magnet-free designs to reduce reliance on rare-earth materials. Electric motors continue to expand into new areas, showing their adaptability and importance in modern transportation.

The year 2025 marks a turning point in the debate between the internal combustion engine and electric motors. Both technologies offer unique strengths and face distinct challenges. A side-by-side comparison helps clarify their differences in performance, efficiency, cost, and environmental impact.

Metric | Gas Engines | Electric Motors (EVs) |

|---|---|---|

Energy Conversion | 12-30% | 77% |

Fuel Efficiency | 25-35 MPG | 100+ MPGe |

Range | 300-500 miles | 250-400 miles (improving) |

Refueling/Charging | ~5 minutes (gas stations) | 30 min (fast charge) to 12 hours (home charging) |

Upfront Cost | $25K - $50K | $35K - $70K (before incentives) |

Maintenance Cost | Higher (oil changes, engine parts) | Lower (fewer moving parts) |

Emissions | CO₂, NOx, particulates emitted | Zero tailpipe emissions; battery production emissions exist |

Environmental Impact | Contributes to climate change | Cleaner air quality; benefits maximized with renewable energy charging |

The internal combustion engine remains popular for its long range and fast refueling. Drivers can travel up to 500 miles and fill up in minutes. Electric motors, however, lead in energy efficiency and environmental performance. They convert more than twice as much energy into motion and produce no tailpipe emissions. Charging times for electric motors continue to improve, but gas engines still hold an advantage in convenience for long trips.

Electric vehicles save drivers $6,000 to $10,000 in fuel and maintenance over ten years. They also improve urban air quality by eliminating tailpipe emissions.

Maintenance needs differ sharply. The internal combustion engine has many moving parts, requiring regular oil changes, tune-ups, and brake replacements. Electric motors use fewer components, which means less frequent and less costly service. Regenerative braking in electric motors extends brake pad life, while battery monitoring replaces many traditional maintenance tasks.

Maintenance Aspect | Gas Vehicles (2025) | Electric Vehicles (2025) |

|---|---|---|

Engine Complexity | Complex combustion engines with many moving parts | Electric motors with far fewer components |

Routine Maintenance | Oil changes, transmission fluid changes, brake pad replacements, engine tune-ups, fuel system cleaning | Battery system monitoring, brake services with longer brake pad life due to regenerative braking, tire rotations, cabin air filter replacements, software updates |

Brake System | Traditional braking causing faster brake pad wear | Regenerative braking extends brake pad lifespan |

Maintenance Frequency | Frequent service needed | Reduced frequency of service visits |

Cost Influencers | Fuel efficiency, driving style, fluctuating fuel prices | Electricity rates, charging habits, battery technology |

Total Cost of Ownership | Higher due to ongoing maintenance and fuel costs | Lower due to fewer maintenance needs and incentives like tax credits |

Electric motors offer lower total cost of ownership, but their higher upfront price remains a barrier for some buyers. Tax credits and government incentives help close the gap. Gas engines perform better in extreme cold and do not suffer from battery degradation, which remains a concern for some electric vehicle owners.

Key trade-offs in 2025:

Gas engines: longer range, faster refueling, lower upfront cost, higher emissions, more maintenance.

Electric motors: higher efficiency, lower emissions, less maintenance, higher upfront cost, charging infrastructure still expanding.

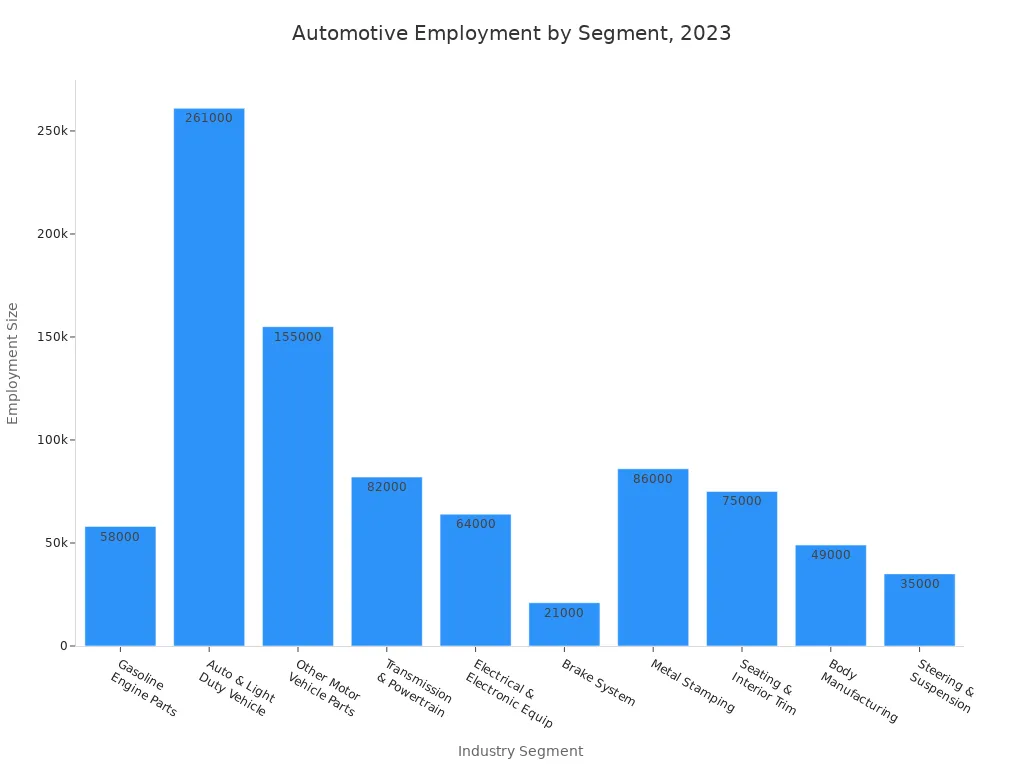

The shift from the internal combustion engine to electric motors is transforming the automotive industry and changing what consumers expect from their vehicles. Manufacturers must adapt to new supply chains, workforce needs, and customer demands.

Automotive supply chains now focus more on batteries and electronics. China controls about 70% of the global lithium-ion battery market and 80% of rare earth elements for electric motors. This creates new risks and encourages recycling innovations by companies like Li-Cycle and Redwood Materials. Automakers such as Tesla and Ford invest in eco-friendly manufacturing and renewable energy use.

Employment patterns are shifting. Jobs related to the internal combustion engine and its parts face high disruption. Gasoline engine and engine parts manufacturing, which employed about 58,000 people in 2023, now sees significant job risk. Other sectors, such as brake systems and transmissions, also experience changes as electric motors require fewer components. However, new opportunities arise in battery production, electronics, and software development.

Industry trends in 2025:

Battery production and recycling become central to the supply chain.

Workforce retraining and retooling support the transition to electric motor manufacturing.

Traditional suppliers must adapt or risk losing relevance.

Consumer expectations have evolved. Many buyers still prefer the internal combustion engine or hybrid vehicles for flexibility and cost reasons. Hybrids appeal to those who want lower fuel costs and emissions without relying on charging infrastructure. Full battery electric vehicles attract drivers interested in environmental benefits and lower long-term costs, but concerns about range, charging, and battery life remain.

Consumers in 2025 seek flexible, cost-efficient solutions. Many choose hybrids or range extenders to balance convenience and sustainability.

Factors shaping consumer choices:

Environmental regulations and incentives encourage electric motor adoption.

High initial investment and charging infrastructure gaps slow full electric vehicle uptake.

Improved battery technology and expanding fast-charging networks increase electric motor appeal.

Younger consumers show interest in mobility-as-a-service models over traditional ownership.

The internal combustion engine continues to play a major role, especially in regions with less developed charging infrastructure. Electric motors gain ground as technology and infrastructure improve. The industry and consumers both adapt to a landscape where engine technology means more than just mechanical power—it now includes digital intelligence, sustainability, and new ways of thinking about mobility.

By 2025, the meaning of "engine" has expanded. People now see it as more than a machine for motion. It includes eco-friendly systems, digital intelligence, and new fuels.

The industry focuses on sustainability, using biofuels, hydrogen, and hybrid powertrains.

Regulations and technology drive cleaner, smarter solutions.

Collaboration shapes future progress.

Aspect | Trend to 2030 |

|---|---|

OEM EV Investment | Over $500 billion planned |

Non-ICE Vehicle Growth | CAGR of 18.9% |

Battery Technology | Solid-state, supply chain optimization |

Government Initiatives | Zero-emission targets, automation |

Future engine technologies will cut fuel use and emissions, making daily travel cleaner and more efficient. Society will benefit from safer, smarter, and more sustainable transportation.

An internal combustion engine burns fuel to create motion. An electric motor uses electricity from a battery to produce movement. Electric motors have fewer moving parts and operate more efficiently than combustion engines.

Electric vehicle engines often last longer than gas engines. Fewer moving parts mean less wear. Many electric motors can run for over 200,000 miles with minimal maintenance.

Hydrogen engines offer zero emissions and high efficiency. They may replace traditional engines in some vehicles, especially heavy-duty trucks. Widespread adoption depends on hydrogen fuel availability and infrastructure growth.

Electric engines have fewer parts that move or wear out. They do not need oil changes or spark plug replacements. This design reduces the need for regular maintenance and lowers repair costs.

Hybrid engines combine electric and gas power. They use less fuel and produce fewer emissions than gas engines. Many drivers choose hybrids for improved fuel economy and reduced environmental impact.